來源:智堡投研

摘要

-

本次會議,聯準會降息25bp,至4.25%-4.5%水平,符合預期。隔夜逆回購工具進行技術性調整至聯邦基金利率的區間下緣。

-

會議聲明的措詞有調整,反映出FOMC考慮後續政策的實施「節奏」和「幅度」都產生了變化。票型也出現了分歧,有委員反對12月降息。

-

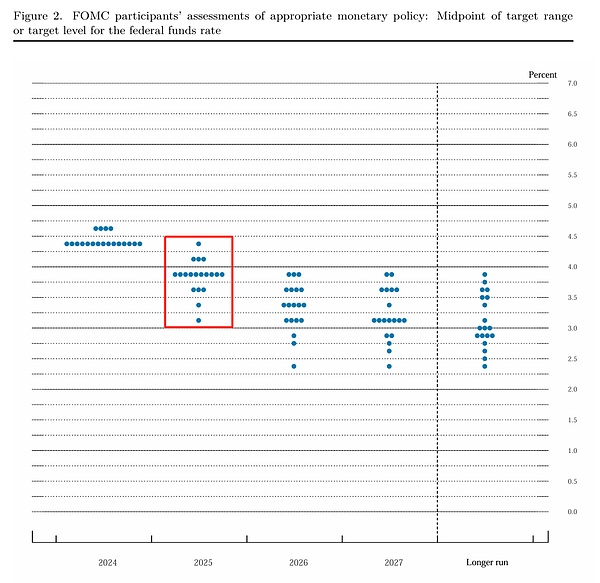

經濟預測明顯反映對通膨風險的擔憂,聯儲的風險平衡顯然再度倒向通膨。點陣圖僅暗示明年兩次降息,展現出絕對的鷹派傾向。

-

在發布會開場白中,鮑威爾提及“more neutral setting”以及對進一步降息的“Cautious”,表態偏鷹派。

-

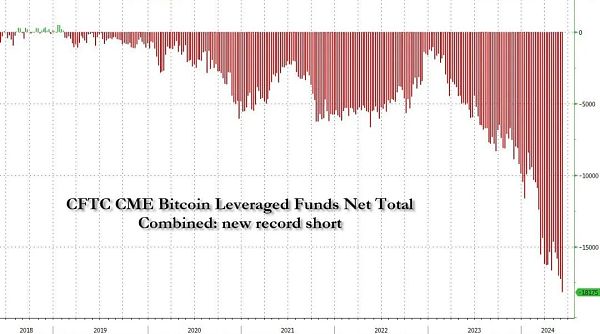

美元/VIX暴漲,美債、美股、黃金、比特幣大幅下跌。

聲明(粗體為變化)

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains . objective but remains somewhat elevated.

近期指標表明,經濟活動繼續以穩健的步伐擴張。自今年年初以來,勞動力市場狀況普遍有所緩解,失業率有所上升,但仍維持在較低水準。通膨率已朝著委員會2%的目標邁進,但仍略微偏高。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in risks to achieving its employment and inflation goals are roughly in risks to on mic the risks to both sides of its dual mandate.

委員會力求在較長時期內達到充分就業和2%的通膨目標。委員會判斷,實現就業和通膨目標的風險大致平衡。經濟前景不明朗,委員會關注其雙重使命的雙向風險。

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/4 to 4-1/2 percent. In considering the extent and timing of addition toal adjustments target range for the federal funds rate, the Committee will carefully assess incoming 資料its 2 percent objective.

為支持其目標,委員會決定將聯邦基金利率目標區間下修25bp至4.25%至4.5%。在考慮進一步調整聯邦基金利率目標區間的幅度和時間時,委員會將仔細評估新收到的數據、不斷變化的前景以及風險平衡。委員會將繼續減持國債、機構債務和機構抵押貸款支持證券。委員會堅定地致力於支持最大限度的就業,並使通膨率回到2% 的目標。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policys Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在評估貨幣政策的適當立場時,委員會將繼續監測所收到的資訊對經濟前景的影響。如果出現可能阻礙實現委員會目標的風險,委員會將準備酌情調整貨幣政策的立場。委員會的評估將考慮廣泛的訊息,包括對勞動力市場狀況、通膨壓力和通膨預期以及金融和國際發展的解釋。

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Voting against the action was Beth M. Hammack, who preferred to maintain the target range for the federal funds rate at 4-1/2 to 4-3/4 percent.

投票贊成貨幣政策行動的有:主席傑羅姆-鮑威爾、副主席約翰-威廉斯、湯瑪斯-巴爾金、麥可-巴爾、拉斐爾-博斯蒂克、米歇爾-鮑曼、麗莎-庫克、瑪麗-戴利、菲利普-傑斐遜、阿德里安娜-庫格勒和克里斯托弗-沃勒。貝絲-哈馬克(Beth M. Hammack)投了反對票,她傾向於將聯邦基金利率目標區間維持在4.5%至4.75%。

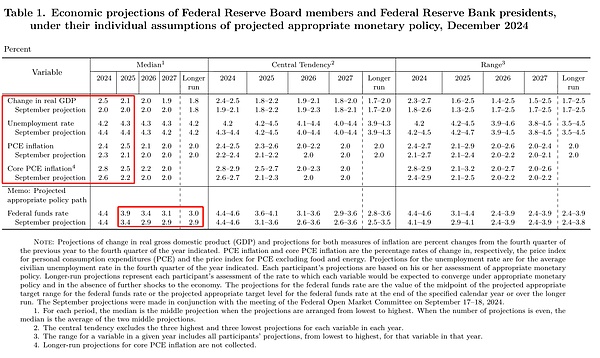

經濟預測與點陣圖

上調24/25年的經濟預測,下調失業率預測,上調通膨預測,25年的通膨預測上調幅度較大。

點陣圖僅指引明年全年降息兩次,展現強烈的鷹派傾向。

問答環節

米摳因生病此次會議並未全程追蹤發表會,具體問答仍待官方文件公佈後整理。